Our Tax Obligation: Here’s What You Need To Know

Your Tax Obligation: Here’s What You Need To Know

If you’ve received a notification about a discrepancy in your tax filings, understanding what this means for you and how to address it is essential. Below, we outline the critical information you need to know regarding your tax obligations and the necessary actions to take.

Understanding Your Tax Obligation: Discrepancy in 2024 Tax Return

Our records show that the total tax you deposited for 2024 is significantly less than the amount you deposited in 2023, leading to a shortfall of Rs. 220,882. This difference is concerning, especially given the current economic inflation and anticipated income growth. Such a decline in your reported tax liability could indicate potential underreporting of income, which may trigger a mandatory audit as per tax regulations.

Key Figures:

- Total Tax Deposited in 2023: Rs. 316,11

- Total Tax Deposited in 2024: Rs. 95,22

Why Your Tax Obligation Matters

A sudden decrease in tax payment can signal issues with income reporting. This could place your tax return in a high-risk category for an audit, increasing the chances of an investigation by tax authorities.

Steps to Address Your Tax Obligation

The law allows you to revise your tax return within 60 days from the filing date to correct any errors or omissions. To ensure compliance with your tax obligation, we strongly recommend that you:

- Review Your Financial Records: Verify all reported income and ensure accuracy.

- Declare Your True Income: Correct any discrepancies in your income declaration.

- Submit Any Additional Tax Due: Pay any outstanding taxes to the national exchequer as soon as possible.

Important Reminder for Your Tax Obligation

This communication is not a formal legal notice, but it serves as a reminder of your responsibility to provide accurate information on your tax return. Promptly revising your filing will help you avoid penalties and ensure compliance with your tax obligations.

Contact for Assistance with Your Tax Obligation

If you need help reviewing or revising your tax return, contact your designated tax office for expert guidance. Ensuring the accuracy of your filings supports the integrity of the tax system and contributes to national development.

Act now to meet your tax obligations and prevent potential audit consequences.

The system is unable to submit return as biometric verification

The system is unable to submit return as biometric verification u/r 5(4) has not been completed.

If you found this error your sale tax biomatric expired now.Please do again visit nadra E-Shulat Office do a biomatric

Appellate Tribunal and High Court Fee

Appellate Tribunal and High Court Fee

Appeal Filing Fee of FBR & High Court Fee are below

Income Tax Appeal Filing fee.Appellate Tribunal and High Court Fee

Appellate Tribunal

Appeal Filing Fee of FBR was 5000 in case of companies and for Others 2500 Now Appeal Filing Fee of FBR is 20,000 for Companies and 5,000 for others.

High Court

Hight Court all cases fee was 100 and NW 50,000.

Timeline to file appeal/Reference

For Companies and all cases to file appeal/rederence was 60 Days and Now 30 Days

Timeline for High Court Cases

All cases before 90 Days and Now 30 Days

If you want to file appeal or any cases related to feel free to contact us.

File Your Tax Return 2023 FBR

File your tax return 2023 FBR otherwise sim will be block by 15th May 2024

To boost tax compliance, the Federal Board of Revenue (FBR) issued an Income Tax General Order (ITGO) for people not on the active taxpayer list but required to file tax returns for 2023. Under section 114B of the Income Tax Ordinance, FBR acted decisively by disabling SIM cards linked to 506,671 individuals in this category. These steps aim to prompt tax compliance and support economic growth.File your tax return 2023 FBR

Key points of the Income Tax General Order (ITGO) are:

- Disabling Mobile Phone SIMs: SIM cards linked to specified individuals’ CNIC will be blocked until restored by the FBR or the relevant tax authority.

- Immediate Effect: The ITGO will be enforced immediately by the Pakistan Telecommunication Authority (PTA) and all telecom operators to ensure swift implementation.

- Compliance Reporting: Telecom operators are required to submit a compliance report to the FBR by May 15, 2024, ensuring transparency and accountability in the enforcement process.

File your tax return 2023 FBR as soon as possible.If you need any help Astro Associates will file your tax retrun.

income tax, sales tax, and federal excise duty Appeals

income tax, sales tax, and federal excise duty Appeals

The Tax Law Amendment Bill 2024, presented by Federal Minister for Law and Justice, Mr. Azam Nazeer Tarar, on 24.04.2024, proposes key changes in how tax appeals are handled in terms of income tax, sales tax, and federal excise duty.

Income tax, sales tax, and federal excise duty Appeals that Under the current system, the Commissioner IR Appeals handles a broad spectrum of tax-related appeals. However, with the introduction of this bill, their jurisdiction will be limited to dealing with income tax appeals up to Rs20 million, sales tax appeals up to Rs10 million, and federal excise duty appeals up to Rs5 million. Appeals exceeding these amounts will now be directly heard by the Appellate Tribunal Inland Revenue (ATIR).

This proposed redirection is part of a broader effort to expedite the decision-making process in tax-related matters, ensuring that cases involving larger sums are handled by the ATIR, which is equipped to deal with more complex and higher-value disputes. As outlined in the bill, all cases currently pending before the Commissioner that exceed these thresholds will be transferred to the ATIR, with a stipulated decision period of 6-months from the date of transfer.

Further, the bill seeks to enforce stricter timelines for the escalation of cases from the Tribunal to the High Court, mandating that such appeals and references be filed within 30-days of receiving the order, with the High Court required to make a decision within 6-months.

The legislative intent behind these reforms is clear. The minister noted that there is currently a staggering Rs2.7 trillion tied up in pending tax cases across various forums, including the Commissioner’s Appeals, Appellate Tribunals, and higher courts. By reallocating the jurisdictional responsibilities and setting firm timelines, the government aims to alleviate the bottleneck in the system and free up a significant amount of resources currently stalled in litigation.

This move has been framed as part of a larger strategy to not only streamline the tax appeal process but also to broaden the tax base, a critical step towards strengthening the national economy. The government has expressed its commitment to transparency in this process, inviting suggestions from opposition parties and other stakeholders, and has consulted with the Tax Bar Association in the drafting of the bill.

However,as per income tax, sales tax, and federal excise duty Appeals bill the proposed changes have not been without criticism. Opposition Leader Mr. Omar Ayub has suggested that the bill should be deliberated further in the Finance Committee, indicating that there may be reservations regarding the specifics of the jurisdictional limitations and the potential impact on taxpayers’ rights to a fair appeal process.

As the bill moves through the legislative process, income tax, sales tax, and federal excise duty Appeals,it will be important to observe how these discussions evolve and what amendments might be proposed to address the concerns raised by the opposition and tax experts alike. If passed, this amendment could represent a pivotal shift in Pakistan’s approach to tax litigation, potentially setting a precedent for future reforms in fiscal governance.

How to apply income tax, sales tax, and federal excise duty Appeals?

What the process of income tax, sales tax, and federal excise duty Appeals?

What is new process of income tax, sales tax, and federal excise duty Appeals?

Sales Tax Return SRO 350

– as per Sales Tax Return SRO 350 Automatic registration is no longer available for individuals, AOPs, and single member companies

– The (LRO) will review and approve registration applications to ensure all required information and documents are submitted.

- Balance Sheet:

(a) Only individuals, associations of persons, and single member companies (excluding manufacturers) shall file a balance sheet.

(b) The balance sheet shall be filed for a specific date, namely:

(i) For persons registered before June 30, 2023, as of June 30, 2023.

(ii) For persons registered after June 30, 2023, as of the date of filing.

(c) No further balance sheet shall be required unless the registration is modified as per Sales Tax Return SRO 350

- Sales Tax Return:

– The Commissioner can reject sales tax returns without a balance sheet.

– The Commissioner may disallow returns with sales exceeding five times business capital if:

– Business capital is not declared.

– Sales don’t arise from bank-financed or credit purchases.

– If you can’t provide information on business capital, loans, and credit purchases, your transactions may be considered suspicious, and the Commissioner may not allow filing

S.R.O.582 2024 Sales Tax

S.R.O.582 2024 Sales Tax

S.R.O.582 2024 Sales Tax In exercise of the powers conferred by section 50 of the Sales Tax Act, 1990, the Federal Board of Revenue is pleased to direct that the following further amendments shall be made in the Sales Tax Rules, 2006,

- for the expression “with corresponding assets in the bank, amounts attributable to partners with percentage, as the case may be, the expression substituted; and

- in the proviso, the expression “within thirty days from the date the said requirement comes into force” shall be omitted

If you need any further help feel free to contact Us.We will guide you.

Please update your registration form to provide balance sheet details

If you find a error duirng the submission of monthly sales tax retrun Please update your registration form to provide balance sheet details u/r 5(2)(f), in order to file sales tax return without approval of commissioner then you shoud file balance sheet in registration form.

- Login IRS acccount

- Click Registration Tab

- Forms

- 14(1) (Sales Tax registration modification to add the balance sheet u/r 5(2)(f)) (Sales Tax)

If you need further help feel free to contact us.

How to submit balance sheet in IRS

How to submit balance sheet in IRS

If you are unable to file march 2024 sales tax retrun and facing error (You have not provided your balance sheet u/r 5(2)(f). Please add the balance sheet or submit a request to your commissioner for approval).Its mean you have not submitted balance sheet as per SRO (350) 2024.How to submit balance sheet in IRS

Please update your registration form to provide balance sheet details u/r 5(2)(f), in order to file sales tax return without approval of commissioner.

How to file balance sheet application 14(1) (Sales Tax registration modification to add the balance sheet u/r 5(2)(f)) Sales Tax?

- Got to registration tab

- forms

- Open 14(1) (Sales Tax registration modification to add the balance sheet u/r 5(2)(f)) (Sales Tax

- Fill all forms

- attach balance sheet

- submit

How to resolve error You have not provided your balance sheet u/r 5(2)(f). Please add the balance sheet or submit a request to your commissioner for approval?

If you are facing error the you should file application 14(1) (Sales Tax registration modification to add the balance sheet u/r 5(2)(f)) Sales Tax.

What are the consequences of not submitting a balance sheet?

- fines

- Suspension of their tax registration.

If you are unabel to know how to submit balance sheet in IRS.Astro Associates will help you to file sales tax retrun and accounts

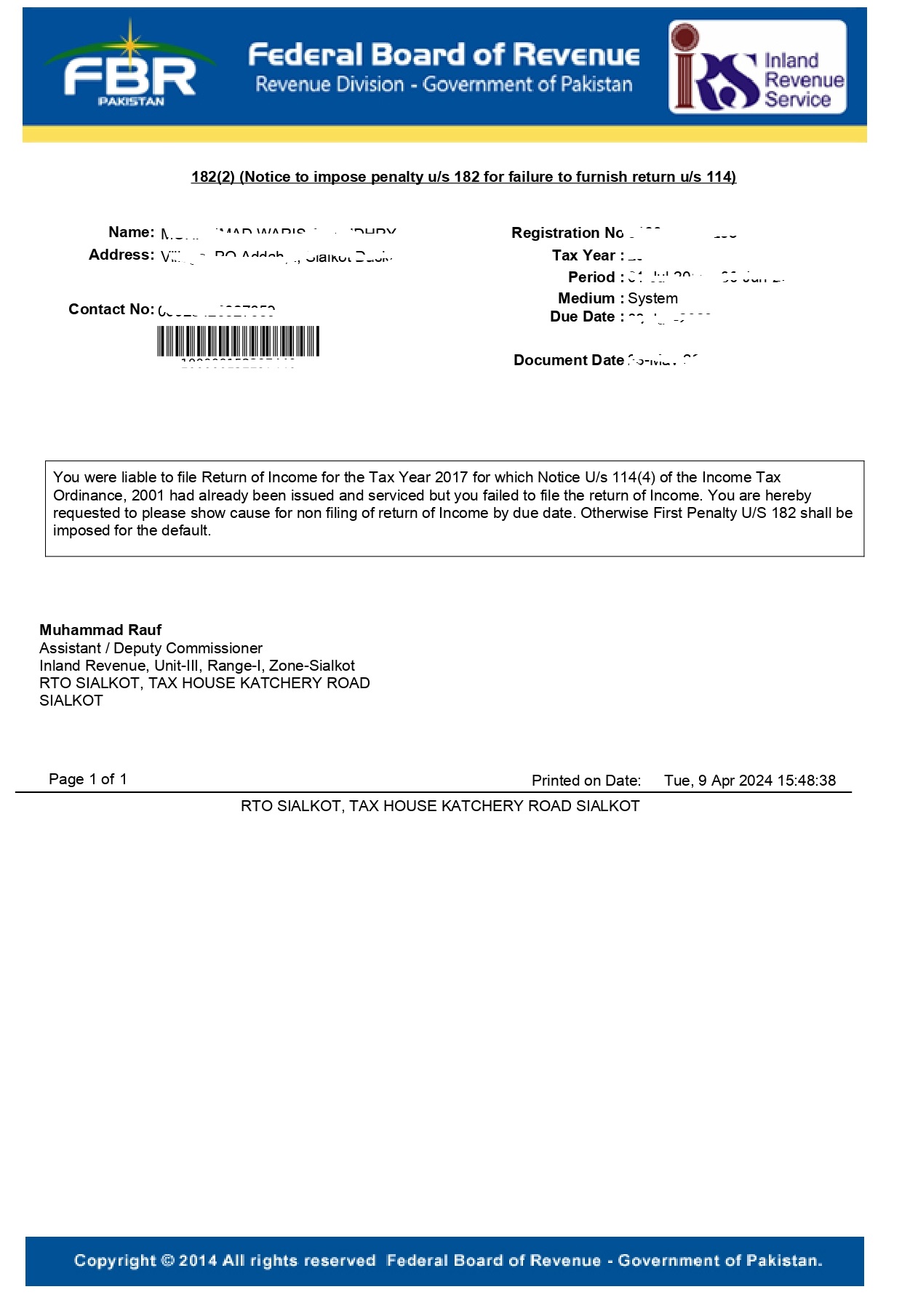

182(2) (Notice to impose penalty u/s 182 for failure to furnish return u/s 114)

182(2) (Notice to impose penalty u/s 182 for failure to furnish return u/s 114)

You were liable to file Return of Income for the Tax Year 2023 for which Notice U/s 114(4) of the Income Tax

Ordinance, 2001 had already been issued and serviced but you failed to file the return of Income. You are hereby

requested to please show cause for non filing of return of Income by due date. Otherwise First Penalty U/S 182 shall be imposed for the default.

Why i received 182(2) (Notice to impose penalty u/s 182 for failure to furnish return u/s 114)?

After the due date of filing time was given to file tax retrun within notice due date but you failed to file your tax retrun so you got the notice.

What should i do if i got 182(2) (Notice to impose penalty u/s 182 for failure to furnish return u/s 114) ?

Last oppurtunity given you shuld file within show cause notice period.